Embarking on the journey to migrate your organisation’s payroll system is a momentous step for any organisation. This article serves as a detailed roadmap for payroll managers and executives navigating the complex process of switching to a new payroll software.

Our aim is to provide you with a structured approach, ensuring a smooth transition while maintaining the integrity of your payroll data.

Understanding the Stakes

The decision to migrate to a new payroll system typically stems from a necessity to transition to a platform that meets the organisation’s requirements more effectively. However, such migrations are inherently complex and allow no margin for error. It is crucial for the organisation to ensure this transition is executed flawlessly, since mistakes can have significant reputational repercussions and could negatively impact the organisation’s employer brand. The challenges you’ll face will typically include:

- Data Complexity – Payroll data migration involves the transfer of vast amounts of sensitive employee information. When one considers the variances in data field definitions between systems, ensuring accuracy can be daunting.

- Precision Requirement – The migration process demands flawless execution. Any discrepancies can lead to incorrect payslips and consequently, potential issues with tax and End of Year submissions.

- Timing – Payroll migrations are time-intensive. Small organisations may complete the process within 1-2 months (to include one or two parallel test runs) between the old and new systems. However, larger organisations typically require 3-4 months to ensure comprehensive coverage of marginal cases, facilitating thorough reconciliation and resolution of any discrepancies.

Given these challenges, engaging with external experts can significantly alleviate the burden.

Outsourcing offers three key advantages:

- Continuity of Operations – Managing the migration whilst allowing employers to concentrate on their core business and freeing up human resources and accounting personnel.

- Efficiency in Learning – Bypassing the steep learning curve associated with a task you’ll seldom undertake.

- Minimising Errors – Leveraging expertise to avoid common pitfalls that could lead to costly mistakes.

By partnering with professionals who have executed the migration process numerous times, it allows businesses to focus on the company’s success ensuring an unmatched level of efficiency.

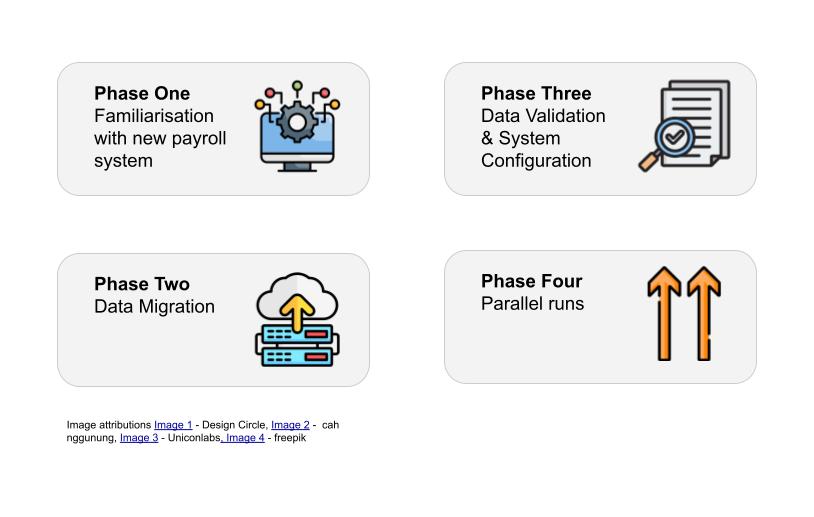

Step-by-Step Guide to Migration

For those opting to manage the migration in-house, here’s a structured approach to guide you through the process:

Phase 1: Familiarisation with the New System

Objective

Understand the fundamental differences between your current and new system. Familiarisation of the core functionalities and processes of the new software is crucial.

Action Points

- Engage in training sessions provided by the new software vendor.

- Conduct a feature comparison to identify key changes in payroll processing.

Phase 2: Data Migration

Objective

Having your data accurately reflected in the new system is the new system, setting the foundation for a seamless transition. The migration process is complex however with careful planning, attention to detail and external support if necessary, it can be managed effectively.

Action Points

This phase is critical and involves meticulous planning and execution:

- Mapping Data Fields – Collaborate with your team to align the data fields from your old system with those of the new system. Utilise the template provided by your new payroll provider for a structured data transfer.

- Challenges to Anticipate during this process are:

- Field Matching – Ensuring data fields such as “Gross” in the old system accurately corresponds with “Gross Basic” in the new system. This requires careful attention.

- Data Extraction – You may need to aggregate data from various reports within the old system to accurately fill in the new system’s migration template.

- Data Compilation – The precision in compiling data, especially sensitive information such as IBAN numbers, cannot be overstated. Errors in this step can lead to significant payroll discrepancies.

- Leveraging Technology – If both the old and new systems support API integration, opt for this method to streamline the data migration process. APIs can automate the data transfer, reducing the potential risk for human error.

- Provider Support – Although the new software provider will offer guidance, it is suggested to prepare your team for the substantial effort required to ensure a successful data migration.

Phase 3 – Data Validation and System Configuration

Objective

To ensure you are all set to use the new payroll software and that payslips, reports and FS documentation are being issued correctly.

Action Points

Once all data has been migrated to the new system, the next crucial steps involve checking and configuring the system. This process is generally categorised into three main areas:

- Global Settings – These settings encompass the overarching system configurations specific to your organisation. Configurations can range from aesthetic adjustments, such as aligning the system with your corporate branding and time zone, to more complex settings like permission levels (determining access and approval rights). Other configurations also include setting leave entitlements, leave booking, notice periods, leave accumulation policies, payslip information details, time and attendance (T&A) rounding rules, late clock-in procedures, and more.

- Departmental Settings – These settings are more granular, tailored to the specific needs of different departments within the organisation. They may include unique permissions, varying payroll issuance schedules, distinct benefits, and different handling of time entries, among others.

- Individual Profile Checks – Arguably the most time-consuming task, this involves two primary focuses:

- Ensuring employment conditions (both written and verbal agreements) are accurately reflected in the new system.

- Verifying personal information, such as tax statuses, national insurance deductions, correctly labelled benefits, accurate leave entitlements and balances, correct IBANs, and any special adjustments like union dues or child support payments.

Although you will likely receive substantial support from your new payroll provider when setting company and departmental configurations, the responsibility for individual profile checks rests solely with your internal payroll team..

Why perform checks after migration and not at the data entry stage? While it may seem advantageous to conduct these checks before migration, verifying these details in the new system ensures completeness and accuracy, addressing any gaps or default settings overlooked by data templates.

Phase 4 – Parallel Runs

Objective

Getting the new payroll system ready to use. This phase is where the theoretical meets the practical. Parallel runs involve processing payroll simultaneously on both the old and new systems for comparison.

Action Points

This step is critical for testing the quality of the migration and identifying any discrepancies between the systems. Understanding and addressing discrepancies is critical to ensure:

- It’s vital to thoroughly investigate and explain any differences found during parallel runs. Failure to reconcile these discrepancies could complicate year-end reconciliations and submissions to tax authorities.

- Tools like VLOOKUP can be invaluable for pinpointing discrepancies. In cases where figures don’t align to the cent, further analysis may be required to identify the source of the variance.

- Discrepancies can result from incorrect data input/migration or inherent differences in how payroll systems calculate. It’s essential to consult with your new payroll provider to understand and account for these variances.

If the payroll migration process is outsourced, you should expect a detailed report outlining all discrepancies, their causes, and proposed solutions. This report requires a high degree of expertise, attention to detail, and patience to compile. Any adjustments identified during parallel runs should be corrected or noted for future consideration, aiming for a scenario where subsequent parallel runs yield no unexplained discrepancies.

Upon successful completion of parallel runs with resolved discrepancies, your organisation is prepared to fully transition to the new payroll system.

Conclusion

Migrating to a new payroll system is a complex but essential process for organisations aiming to improve efficiency and meet evolving needs. This guide has detailed the crucial steps involved, from initial familiarisation with the new system to meticulous data migration to thorough system configuration and rigorous parallel runs. Each phase is vital to ensure a seamless transition, minimising errors and aligning the new system with both organisational and employee-specific requirements.

The success of a migration hinges on careful planning, attention to detail, and, when necessary, leveraging external expertise to navigate the process’s intricacies. Ultimately, a well-executed migration not only enhances payroll management but also supports the organisation’s broader operational goals.

We understand the complexities and challenges that come with migrating payroll systems. While it may seem as though we’re steering you towards our services, our primary goal is not self-promotion but empowerment. Through this guide, we aim to outline the complexities of an often underestimated and under-resourced HR project. We want you to draw from our wealth of experience to avoid instances where migrations faced hurdles due to late expert intervention. Our intent is to foster awareness and preparedness, to ensure your migration process is smooth and successful from the start.

Should you find yourself in need of further information or seeking expert assistance with your payroll needs, we are here to help. Contact us on admin@payrollmalta.com or call us on 2258 8019. We will ensure that your payroll system migration is painless and smooth.

Photo by: Lex Photography