Payroll administration is the very essence of the relations between staff and management, despite being a non-core activity. Payroll mistakes—such as over or underpayment—and late payments can easily taint employee enthusiasm. As a result, engagement might drop, and performance may plummet while turnover soars.

Well-handled payroll, however, delivers security, increases trust, and boosts loyalty. Whether a dedicated person/department deals with payroll management—hopefully, equipped with excellent software—or the company outsources the function to a bureau, precise and timely payment of salaries is not only a legal requirement but also a business’s duty to support staff.

Doing payroll management well means that a firm has a proper understanding of essential payroll processes, improvement areas, related legislation and necessary documentation. PayrollMalta has put together a customised guide to help you understand the complexities better.

1. What is payroll?

The word “payroll” came into usage around the 1900s, while the term became commonly used after the 1950s, according to the corpus of Google Books. In a literal sense, payroll originally meant the list—hence “roll”—of employees a company would have.

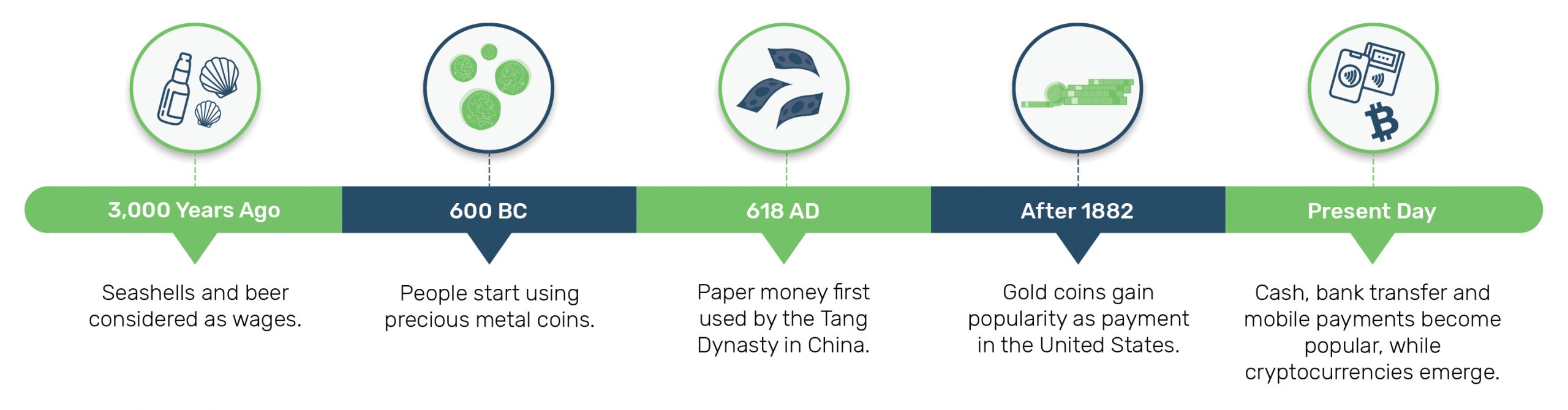

From an employee’s perspective, payroll is better-known as “payday”. Approximately 3,000 years ago, workers would receive wages in rather exciting ways: seashells and beer, for example. People started using precious metal coins as payment around 600 BC. More than a millennium later, paper money payments came into fashion once the Chinese Tang Dynasty started using it around 618 AD. Gold was first used as remuneration a century ago: people started using gold certificates—freely convertible into gold coins—after 1882 in the United States.

The times of paying for jobs in shells and beer have faded—in most of the world. Today, people usually receive their wages in cash, cheque or by bank transfer. (Cryptocurrencies are also gaining popularity, although their trust factor remains heatedly debated). Salary payments must come with payslips, providing a breakdown of wages and taxes paid, according to the law.

Nowadays, payroll is more complicated than ever: it goes well beyond a simple roster. Payroll management has become the pinnacle of an excellent—or less preferably: a degraded—relationship between the corporation and the worker.

2. Understanding Net Salary

Usually, when a position receives a salary tag, we talk about gross pay, including benefits and allowances, as well as taxes and contributions. However, when payday comes, the employee receives less: the net salary. Net pay is the actual compensation after the deduction of taxes and contributions.

In Malta, we calculate the net salary considering several factors:

- Tax Rates

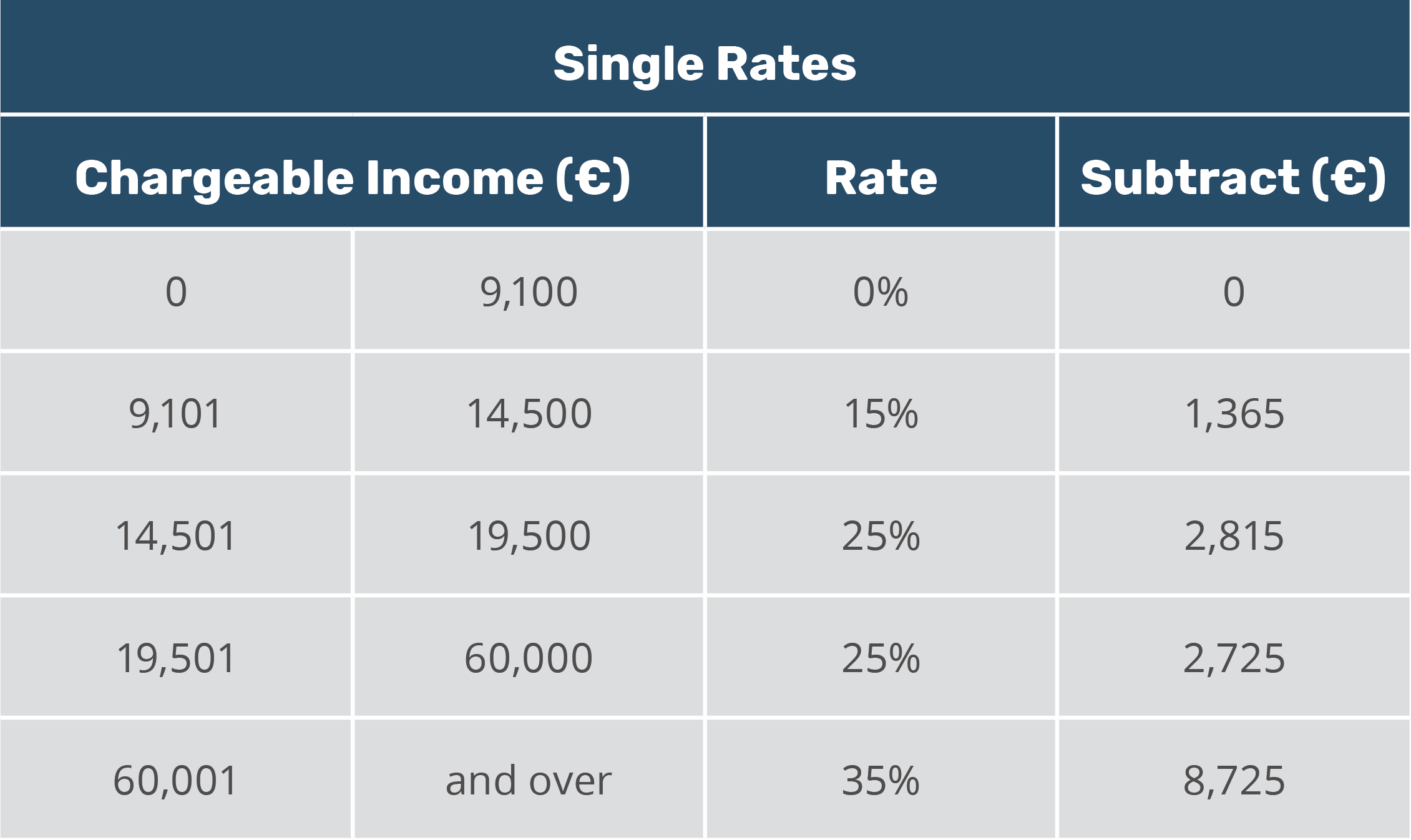

- Single Rates

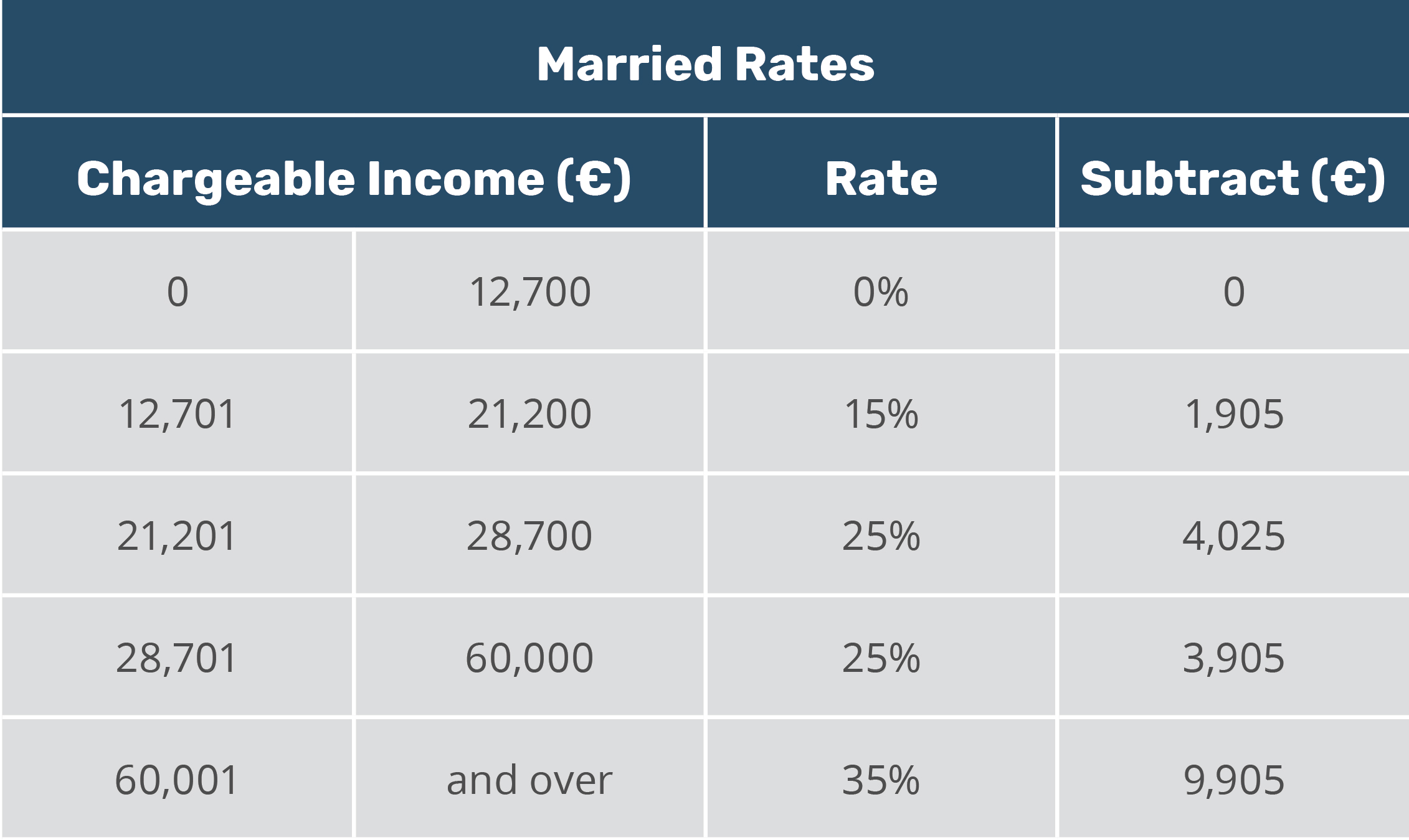

- Married Rates

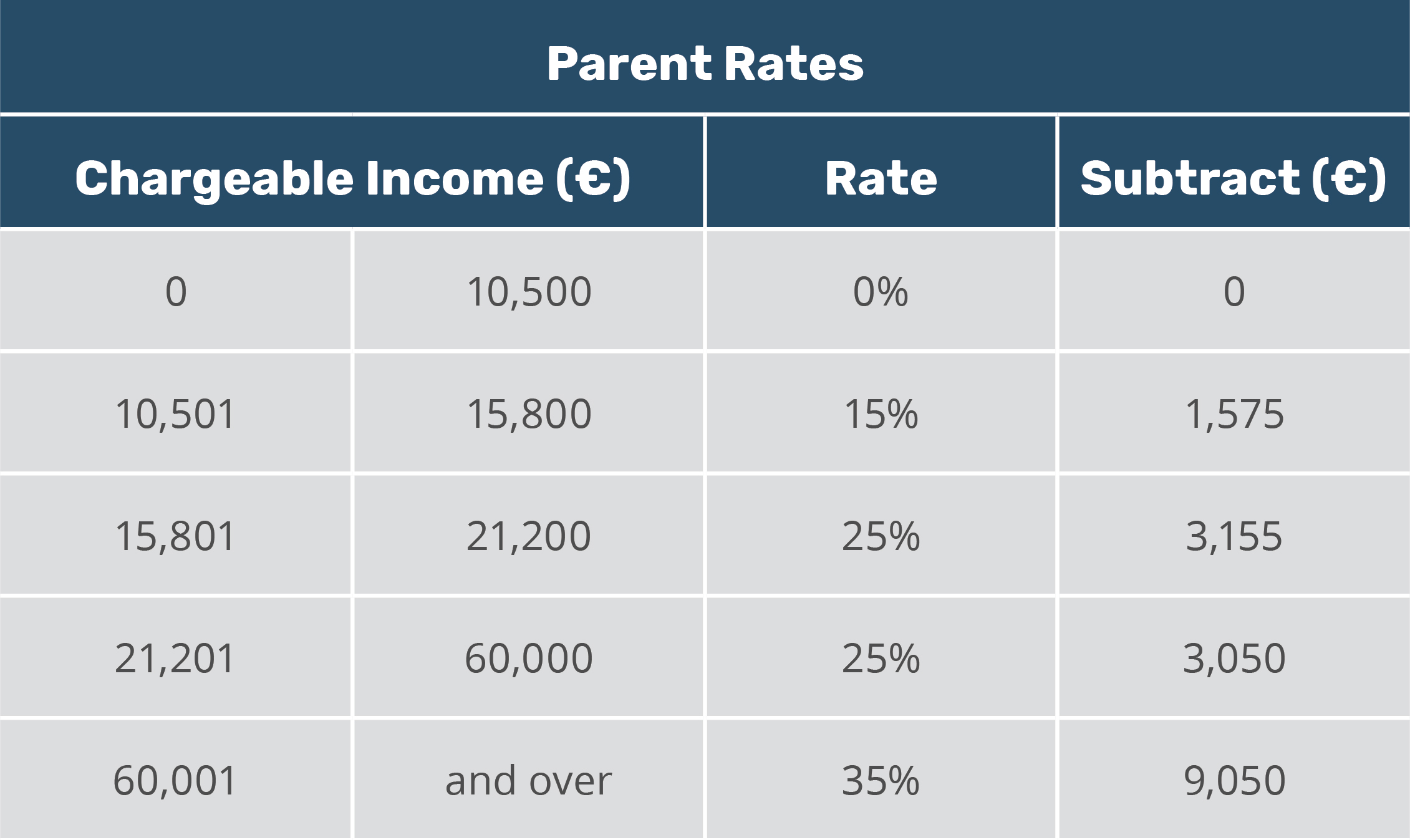

- Parent rates

- Social Security/National Insurance (SSC/NI) contributions

- Class One

- Class Two

- Government Bonuses

- Allowances

Tax rates

Tax brackets in Malta differ for taxpayers based on whether they are single, married or parents. The tax brackets for 2021 are as follows:

The actual brackets are available on the official website of the Office of the Commissioner for Revenue (CfR).

Social Contributions

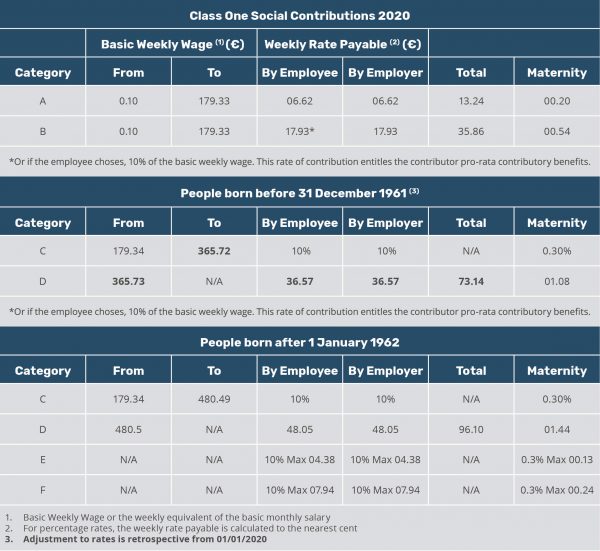

Class One

There are several categories for determining the rate of Class One social contributions.

- A) People younger than 18, earning less than the amount below.

- B) People older than 18, earning less than the amount below.

- C) People making a basic weekly wage is between the amount below.

- D) People earning a basic weekly salary that is equal or above the amount below.

- E) Students* younger than 18.

- F) Students* older than 18.

*Students enrolled in a full-time course, under the Student-Worker Scheme—or similar schemes, including the Extended Skills Training Schemes, but excluding the Worker-Student Schemes—involving distinct work and study periods for which they are receiving remuneration.

(source: Office of the Commissioner for Revenue – Class 1 Social Security Contributions)

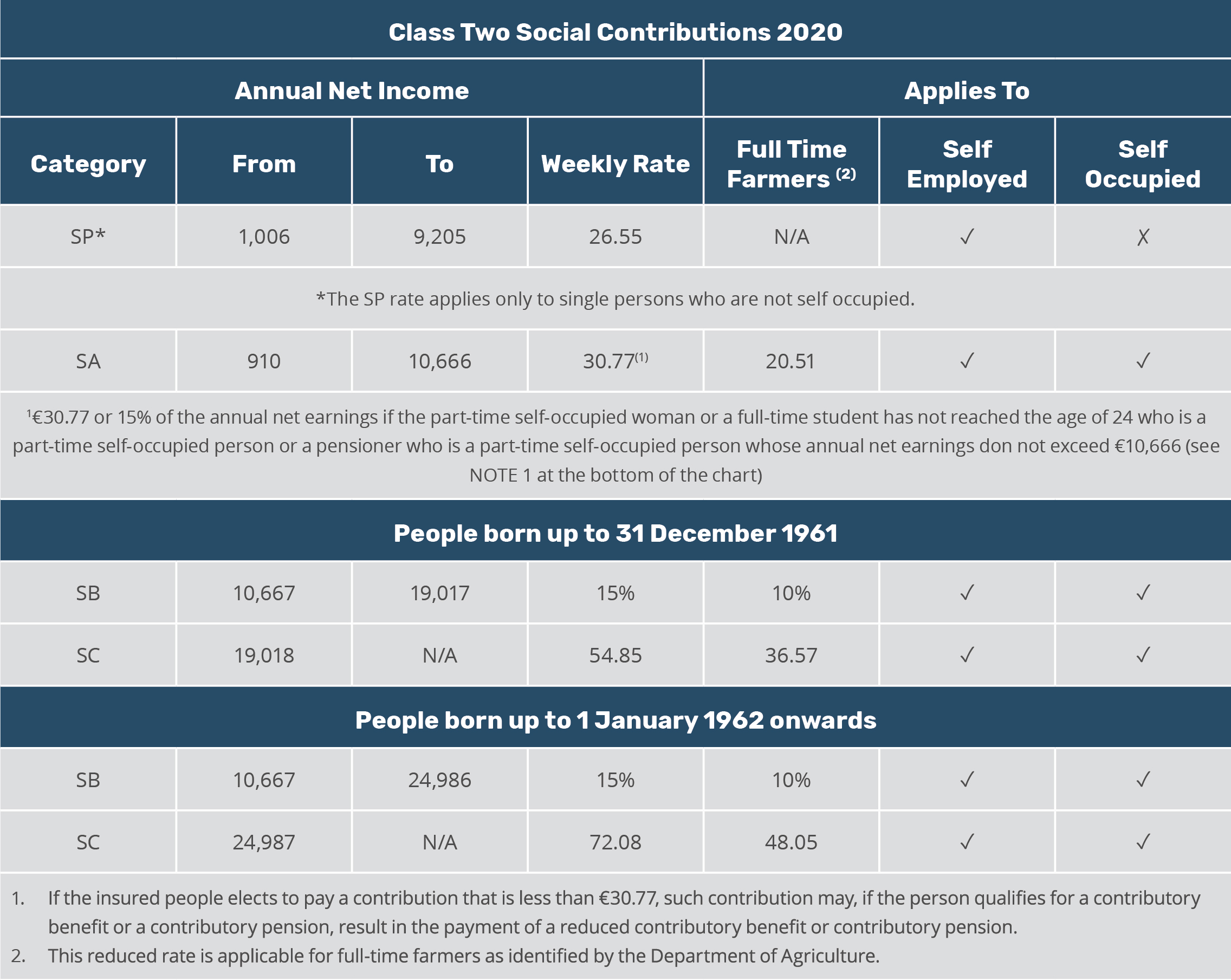

Class Two

Individuals earning more than €910 from an economic activity who are not employed must pay Class Two social contributions. Under the Social Security Act, two categories apply in such cases.

- Self-occupied people with €910+ annual income from trade, business, profession, vocation or any other economic activity.

- Self-employed people receiving income from rents, investments, capital gains or any other income.

The tax authority bases rates on the annual net profit or income for the year preceding the contribution payment year.

(source: Office of the Commissioner for Revenue – Class 2 Social Security Contributions)

3. Payroll process

The first step is to establish the corporate payroll policy. Business leaders must focus on establishing a well-defined framework of their strategies to make sure that the organisation can flourish.

The first step is to establish the corporate payroll policy. Business leaders must focus on establishing a well-defined framework of their strategies to make sure that the organisation can flourish.

As payroll management is in contact with all employees, it has to collect data from all over the organisation. This information is cross-checked for validity to see if it adheres to company policies.

As payroll management is in contact with all employees, it has to collect data from all over the organisation. This information is cross-checked for validity to see if it adheres to company policies.

After validating all the data, staff have to transfer it to the system for processing and factors in the necessary deductions and taxes to establish the net salaries of employees, and the fees the company has to pay to the respective authorities.

After validating all the data, staff have to transfer it to the system for processing and factors in the necessary deductions and taxes to establish the net salaries of employees, and the fees the company has to pay to the respective authorities.

Once they calculated the net salary and deducted the contributions, payroll staff pay the taxes and submit the necessary documentation to the respective authorities.

Once they calculated the net salary and deducted the contributions, payroll staff pay the taxes and submit the necessary documentation to the respective authorities.

All financial transactions an organisation initiates and receives must be recorded. As salaries are part of the operating costs, all reimbursement data must be logged in the accounting system, as well as expenditures.

More often than not, payments are delivered via bank transfer, in cash or by cheque. Remuneration must also come with payslips, so the employees have a breakdown of their wages and taxes paid for the given period.

More often than not, payments are delivered via bank transfer, in cash or by cheque. Remuneration must also come with payslips, so the employees have a breakdown of their wages and taxes paid for the given period.

The management may necessitate reporting related to payroll information, which can include—but is not limited to—costs by department, location and position, for example. Leave reporting is also widespread and gives employers the ability to keep tabs on leave and sick leave management. Payroll reporting is an essential part of understanding business operations better as the data helps in making better-informed decisions.

The management may necessitate reporting related to payroll information, which can include—but is not limited to—costs by department, location and position, for example. Leave reporting is also widespread and gives employers the ability to keep tabs on leave and sick leave management. Payroll reporting is an essential part of understanding business operations better as the data helps in making better-informed decisions.

4. End-month vs end-year payroll

Compliance-wise, monthly payroll includes submitting an FS5 form (which registers the income, taxes, social security contributions [SSC] and maternity leave fund contributions [MLF]) to the Commissioner for Revenue (CfR).

However, the end of the year complicates the compulsory regulatory administration. Annually, a business must submit an FS3 form for each employee, and one FS7 form for the company. A handful of tips hand-picked by PayrollMalta’s professionals can help you in increasing your submission accuracy.

5. Payroll mistakes

Payroll mistakes are particularly painful for a business, as they can make employees disgruntled, which taints engagement and loyalty. Also, fixing such errors involves laborious administrative tasks, while changes need to be communicated to the watchdog, which increases compliance pressure.

Most common mistakes

Miscalculating pay is probably the most common mistake, and it is hard to swallow. Misclassifying an employee can lead to lengthy liaison with the Inland Revenue Department (IRD). Missing a submission deadline to the IRD will result in paying penalties. Keeping haphazard records can cause havoc during an external audit, while it hurts payroll workflow.

Tips for avoiding mistakes

Probably the most vital aspect is staying up-to-date with legislation, and payroll and tax-related information. Staying mindful about the hard deadlines and following a precise payroll calendar can also significantly boost error avoidance. Review the most recent tips to avoid payroll mistakes. Alternatively, outsourcing to an experienced payroll bureau will increase the chance for a zero-error payroll.

6. Payroll ways

In house

Some businesses will consider handling payroll in house, which approach may work well for smaller companies, who also often choose outsourcing, so they can increase focus on business operations for better performance. Furthermore, the larger the company is, the more convoluted payroll can become—scalability often comes with stress and complexities.

Manual

Running payroll manually usually means recording and archiving on paper. The company may use word processing and spreadsheet software—e.g. Microsoft Office or Google Suite—, still, documents created this way are likely to get printed and stored offline.

However, such an approach does not allow for flexibility, increases the possibility of clerical and mathematical errors, makes it challenging to alter roster, boosts chances for duplication and omission of data, and makes implementing regulatory changes a nightmare. Such operations are obsolete and hinder positive output.

Running paper-based payroll operations leads to laborious administration, difficulties with auditing—whether internal or external—, and archiving issues. Streamlining outdated mechanisms can significantly help foster positive outcomes. Manual payroll may seem cheaper; however, factoring in the time spent on keeping up with administration reveals losses.

Digital

If a company is committed to keeping payroll operations in house, buying specific software can help. Usually, such solutions either come with a one-off fee or with a subscription and recurring payments. Paying for membership means that beyond the piece of software, the subscriber receives a service that ideally comes with live support. Using designated software decreases time spent on payroll and reduces mistakes, while staff will also work happier with increased focus.

What should companies look for when choosing a payroll software provider in Malta?

An excellent piece of payroll software has reliable support and ongoing updates, which makes sure that issues are dealt with, and features are up to date. It is beneficial to choose a digital solution that comes with a complete HR suite too, as integration can help streamline human resource management—employee onboarding, employee database and records, leave management, and time and attendance—along with payroll.

Payroll software meeting the highest standards must:

- offer seamless integration to other software, preferably with other modules by the same provider;

- manage payroll calculations to increase accuracy levels;

- provide payroll reporting to understand processes better;

- allow for the management of salaries and bonuses with ease and in bulk;

- generate and distribute payslips, preferably automatically;

- handle FSS documentation;

- make bulk adjustments to multiple employees simultaneously;

- be cloud-based—as smart devices and laptops are becoming obsolete every two years on average, you must make sure that new devices and tools plug into your system with ease.

Payroll Outsource

To avoid unnecessary hassle, the number of companies outsourcing their payroll is increasing exponentially.

Running a business in the 21st century is more complicated than in any other time in history. Usually, enterprises separate strategic from non-strategic activities. Payroll, a non-core operation, can easily be outsourced without tainting business operations.

Outsourcing payroll helps increase focus and morale, and helps save money and time. Transferring accountability legally to a payroll bureau mitigates risks and overcomes concerns.

Taking payroll administration outside the company may sound intimidating; however, following a logical multi-step plan ensures a seamless outsourcing process.

- Planning is a crucial part of outsourcing, as it helps all the parties in the process see the steps clearly.

- Setting expectations helps in meeting goals to make sure that the payroll provider of choice ticks all boxes that the outsourcing company requires.

- Probing the market by reaching out and asking for quotes helps establish what different payroll bureaus can offer and assists in creating a valid image of the market. Any interaction with a provider should spark positive feelings, as it is imperative to have a good gut feeling about the payroll bureau that is taking over the function to ensure successful cooperation.

- Agreeing on the process by signing a contract establishes the lines legally, and clearly defines accountability: all parties should unanimously agree on the steps and included procedures.

Outsourcing. As soon as a company outsources payroll, day-to-day operations immediately become less burdensome. The focus and engagement of employees increase, leading to a better business performance, which helps save money.

Outsourcing comes with many benefits, and following a thorough guide on the process can help you establish a detailed plan.

7. Resources & Links (CfR & IRD)

For Individuals

- Profit & Loss Account

- TA22 – Part Time Self Employed

- TA23 – Part Time Employment

- TA24 – Tax from Rents from Residential & Commercial Lets

- Application Form – Parent Rate

- PT Reduction Form

- FS4 – Payee Status Declaration

- Tax Return Help Booklets

- Return Attachments

- CGT Schedule A

- CGT Schedule B

- CGT Schedule B1

- CGT Schedule C

- CGT Schedule D

- CGT Schedule E

- CGT Schedule F

- Cultural & Creative Course Fees Claim for Deduction

- School Transport Fees Claim for Deduction

- Expatriates Taxpayer Registration

- SSC Refund 15(7) (Maltese Version)

- SSC Refund 15(7) (English Version)

- SSC Refund 15(8) (Maltese Version)

- SSC Refund 15(8) (English Version)

- Farmers and Breeders Application for Reduced SSC Class 2 Rates

- Request for Remission of Additional Tax and Interest

- Registration

- Tax Return Cycle

- Refunds

- Pensions

- Tax Rates

- Social Security Contributions Rates

- SSC Calculator

- Special Schemes

- Part-Time Self-Employed Online Form

- Tax on Part-Time Employment Online Form

- Tax on Rental Income Online Form

- Online Services

- Downloads

- eForms

For Corporate

- Application for the Registration of an Employer (by an Individual)

- Application for the Registration of an Employer (by a Company)

- PE Number De-Activation Form

- PE Number Re-Activation Form

- FB2 – Application for a Reduced Rate for Point to Point Service or Delivery (English Version)

- FB2 – Application for a Reduced Rate for Point to Point Service or Delivery (Maltese Version)

- CFR Services Online Portal for Employers

- FS3: Payee Statement of Earnings

- FS4: Payee Status Declaration

- FS5: Payer’s Monthly Payment Advice

- FS7: Payer’s Annual Reconciliation Statement

- FB1: Fringe Benefits Personal History Sheet

- FSS Circular & Updates

- FSS Circular Archives

- Tax Rates

- Social Security Contributions Rates

- SSC Calculator

- Tax Return Cycle

- VAT Return Cycle

- International Taxation

- Share Transfers

- Partnerships

- Employers

- Tax on Rental Income Online Form

- Corporate Online Services

- Corporate Downloads

- eForms

For Small Businesses

- Tax Return Cycle

- VAT Return Cycle

- Tax Rates

- Social Security Contributions Rates

- Employers

- Part-Time Self-Employed Online Form

- Tax on Rental Income Online Form

- eServices

- Downloads for Small Businesses